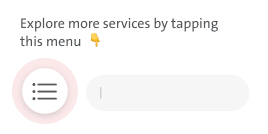

Brand Finance: Boubyan Fastest Growing Brand in Kuwait at Growth Rate of 33%

Al-Majed: Being on the List of Most Valuable and Fastest Growing Kuwaiti Brands Highlights Our Success in Striking an Ongoing Balance between Expansion, Profitability and Excellent Customer Service

Boubyan Bank made a new achievement that adds to its successes over the past years, as the bank was ranked on the list of the top 10 most valuable and strongest Kuwaiti brands in terms of valuation for 2023, in addition to being ranked the fastest growing at a growth rate of 33% as per Brand Finance, the international brand-valuation consultancy.

Mr. Adel Al-Majed, Vice-Chairman & Group Chief Executive Officer of Boubyan Bank Group, stated: “With this type of remarkable recognitions, we are reaping the fruit of our success and steady steps built on well-studied strategies that enabled us to make great leaps and growth across all our financial indicators, especially our market shares across various sectors.”

He elaborated: “Climbing to the 7th place and improving our ranking to AA- is based on our strong financial performance and expectations for future growth against specific standards such as our profit margin and revenues, and this valuation reflects as well the trust of our customers and shareholders in Boubyan Bank.”

He added: “Confirming that we are the fastest growing brand by Brand Finance, following studies and market researches, is a recognition that we highly value, especially since it comes from a consultancy that is renowned for its fairness and professionalism.”

“Reaching to where we were in 2022 was not easy; however, we can attribute our success to setting up a clear strategy, assembling an experienced executive team, returning to basics of banking business, focusing on customer service, investing in digital banking services, investing in our human resources, and focusing on national cadres.”, Al-Majed highlighted.

Headquartered in London, Brand Finance is a consultancy that specializes in brand valuation and offers finance and marketing consultations with offices in over 20 countries worldwide.

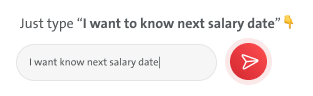

** Improving Digital Banking Services

Al-Majed pointed out: “Boubyan Bank always seeks to improve the level of digital banking services towards a more creative and flourishing future, where customer’s convenience is our priority worldwide. This strategic investment that meets the various and changing demands of corporate and SMEs’ customers will confirm the position of Boubyan Bank as a leading Islamic digital bank, locally, regionally, and internationally.”

He elaborated: “Over the past years, Boubyan succeeded in completing the acquisition of the Bank of London and the Middle East, where Boubyan’s current holding stands at 70% approximately, and then Boubyan Bank announced the full launch of the new unique brand “Nomo Bank” in Kuwait and the U.K. as the first Islamic digital bank from London which can offer its services to Boubyan Bank’s customers and non-customers.

The bank aspires to become the Islamic bank of choice for GCC customers in the United Kingdom as we have incorporated a set of main principles for the bank as a part of its transformation strategy following the acquisition, including having a sustainable customer-focused brand aligned with Boubyan Bank’s Group.

Boubyan Bank concluded 2022 with KD 57.8 million in net profits at a growth rate of 19%, with an earnings per share of 14.2 Fils along with a recommendation to distribute 6 Fils in cash and 6% in bonus shares. Moreover, the bank continued its prudential approach by allocating KD 43.6 million in provisions.

All of the bank’s key indicators witnessed a remarkable growth in 2022, where the total combined assets of Boubyan Bank Group increased to KD 7.9 billion at a growth rate of 7%. Moreover, the total of customers’ deposits grew by 6% to reach KD 6 billion, while the financing portfolio grew by 7% to reach KD 5.9 billion, and operating income grew by 7% to reach KD 201 million.

.bc47546ea519.svg)