Boubyan USD Liquidity Fund

As of 28/7/2015, the par value of the fund’s units have been adjusted from USD100/unit to USD10/unit. This change did not affect total value.

Fund Objective

Providing Shariah-Compliant competitive returns as the Fund seeks to increase the Net Asset Value while realizing a high liquidity level.

Executive Committee

- Badria Hamad Al Humaidhi

- Asok Kumar Ayinikkal

- Mohammad Mane Alajmi

- Omar Abdulaziz AlRasheed

- Abdulmohsen Sameer Al Gharaballi

Net Asset Value (NAV): USD 12.1692

| Performance (as of 22-April-2025) | |

| Annualized 1 Week Return | 4.200% |

| Annualized 1 Month Return | 4.205% |

| Annualized 3 Months Return | 4.248% |

| Annualized 6 Months Return | 4.302% |

| Annualized YTD Return | 4.258% |

| Annualized Return Since Inception (22/05/2014) | 1.958% |

| Cumulative YTD Return | 1.325% |

| Cumulative 1 Year Return | 4.525% |

| Cumulative 2 Years Return | 8.998% |

| Cumulative 3 Years Return | 11.467% |

| Cumulative 5 Years Return | 13.023% |

| Cumulative Return Since Inception (22/05/2014) | 21.692% |

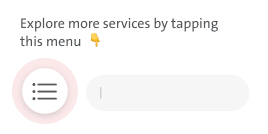

Monthly Report

Subscription Form

Articles of Association

Fund Strategy

The fund will invest in short and medium term Shariah-Compliant instruments, Wakalah and Murabaha deposits with banks, and high quality government and/or corporate Sukuk. The fund may also invest in other investment funds that have a similar investment objective.

Why invest in the Boubyan USD Liquidity Fund?

- Potential returns higher than one month USD fixed deposit rate.

- High quality and low risk investments.

- Flexible online subscriptions and redemptions

- Weekly liquidity

Fund Facts

| Fund structure | Open-ended |

| Currency | US Dollar |

| Capital | Variable (from USD 7 million to 360 million) |

| Minimum subscription | USD 1,000 |

| Subscription fees | None |

| Management fees | Up to 1% per annum |

| Fund manager | Boubyan Capital Investment Company K.S.C.C. |

| Promoter | Boubyan Bank K.S.C. |

| Custodian & investment controller | Gulf Custody Company K.S.C.C. |

| Shari'a auditor | Shura Sharia Consultancy |

| Auditor | Ernst & Young |

.bc47546ea519.svg)