Corporate Governance

Driven by the fundamental belief of adopting and implementing a well developed and structured Corporate Governance system with high standards and professional practices, Boubyan Bank has a Corporate Governance Manual (the “Manual”) that reflects the responsibility and commitment of the Bank toward best industry practices, shareholders’ and stakeholders’ rights, and social responsibilities.

The Manual is designed as a reference and guidance to assist all areas of concerns, namely the Board, Management, and Staff at the Bank to carry out their duties effectively and efficiently, and in accordance with the Bank’s fundamental belief on proper Corporate Governance.

Further, it is prepared in accordance with the Principles of Corporate Governance set by the Central Bank of Kuwait (the “CBK”), and based on the nine pillars as follows:

|

The Manual aims to ensure a proper Corporate Governance system through promoting following aspects:

- Discipline

- Transparency

- Independence and objectivity

- Accountability

- Responsibility

- Social Responsibility

The Board Committee reviews the Corporate Governance Manual on a periodic basis or when required to ensure that the Bank continues to adopt high standards and professional practices. In case of any recommended amendments or updates, the same will be presented to the Board of Directors for review and approval.

The Manual refers to a set of appendices as supporting documents and integral parts, which includes, but it is not limited to:

- Board Charter

- Board Committees

- Group Structure

- Code of Conduct

- Conflict of Interest Policy

- Confidentiality and Bank Secrecy Policy

- Transparency & Disclosure

- Shareholders’ Rights

- Stakeholders’ Rights

Board Charter

Boubyan Bank adopts a “Board Charter” in line with the Companies’ Laws in Kuwait, and the Article of Association and By-Laws of the Bank. The Board Charter addresses aspects and activities related to the Board as summarized below:

- Duties and responsibilities of the Board of Directors on general, operational, financial and control, and administrative aspects.

- Board meetings - invitation, attendance, minutes of meetings and resolutions.

- Roles of the Chairman, Vice-Chairman, Board Director, and Secretary of the Board.

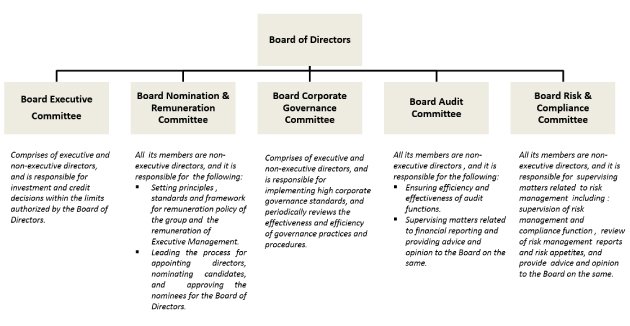

Board Committees

The Board established all the key Board Committees consisting of Executive and Non-executive and independent Directors in line with the Corporate Governance requirements. The Chairperson of each Board Committee reports on a quarterly basis to the Board on the activities of the respective Board Committee. The Key Board Committees are summarized as follows:

|

Group Structure

The Board of Directors is responsible not only for the activities of the Bank, as a standalone entity, but also for the overall management of the Group, especially the significant risks. Hence, the Bank oversees the overall performance of the Group entities in line with its strategy and risk appetite, while respecting the independency of legal and governance responsibilities applicable to each respective Group entity.

Boubyan Bank manages its Group Structure under the following main activities:

- Managing Current Group Structure

- Acquisition / Incorporation of Group Entity

- Disposal of Group Entity

Code of Conduct

In line with our objective of having high ethical and behavioral values, and based on the beliefs that the values are tones set at top, we adopt a “Code of Conduct” applicable to the Board, Management and employees, who should all ensure adherence to the same.

The “Code of Conduct” addresses various standards, which are categorized as follows:

- Compliance with Laws, Rules and Regulations: including laws, Islamic Sharia’a, Central Bank of Kuwait instructions, Capital Markets Authority regulations, and Banks’ policies and values.

- Professional Standards: addressing various matters such as exercise of due care, objectivity, and confidentiality.

- Personal Standards: covering ethical values, personal trading in Boubyan stocks, conflict of interest, training, and gift handling.

- General Standards: including public statements, announcements in newspaper or other media, and Anti-Money Laundering and Know You Customer practices.

Conflict of Interest Policy

Boubyan Bank established clear guidelines for its Board, Management and employees on potential incidences of conflict of interest, where a concerned party might be influenced with a biased discussion and decision, driven by direct or indirect benefits. All concerned parties at the Bank should adhere to the guidelines related to conflict of interest, including disclosure of such potential incidences and withholding any participation in the respective discussions and/or decisions.

Confidentiality and Bank Secrecy Policy

Boubyan Bank treats confidential and proprietary information as one of its most valuable assets, which includes but is not limited to names and lists of customers, proprietary investment techniques, strategic plans, source codes, employee information, customer information and financial information.

Accordingly, the Bank set the required principles and general guidelines in order to maintain confidentiality of the Bank’s information and to ensure compliance with all applicable regulations issued by the Central Bank of Kuwait and Capital Markets Authority in respect of confidentiality and banking secrecy.

Transparency & Disclosure

Boubyan Bank set a master disclosure policy addressing periodic disclosures as well as timely disclosures, and aiming to promote transparency and discipline by developing a set of disclosure guidelines and requirements which will allow all concerned parties, including Board, shareholders, market participants, and regulatory bodies to assess relevant information about the Bank.

Shareholders’ Rights

Boubyan Bank adopts a policy for Shareholders’ Protection Rights based on the principles of transparency and equal treatment; the Bank respects the rights of the shareholders, including compliance with all applicable laws, regulations, and instructions pertaining to protection of shareholders’ rights. We treat all shareholders, including minority and foreign shareholders, on equal basis, and without any discrepancy in respective rights.

Stakeholders’ Rights

Boubyan Bank adopts a policy for Stakeholders’ Protection Rights based on the principles of respect and appreciation.

The Bank complies with all applicable laws, regulations, and instructions pertaining to protection of shareholders’ rights, including Law # 32 for year 1968 regarding Cash, Central Bank of Kuwait and Organization of the Banking Profession.

The Banks identified the following main stakeholders’ groups:

- Shareholders

- Clients

- Regulatory bodies

- Employees

- Community

For further information, kindly refer to the Governance manual

.bc47546ea519.svg)