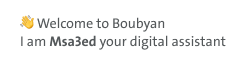

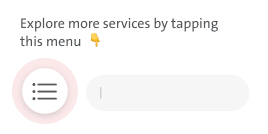

Perspective of Islamic Banking

Shari'a Compliant Banking

Islamic banking is a banking or financing activity that complies with Shari'a Islamic law and is applied in practice through the development of Islamic economics.

Offering a combination of services under Shari'a law and ethics cultivates an ideal relationship between banking and business and has progressively dominated the domestic banking landscape across the world in the 21st century.

A primary challenge facing Islamic banking today is the reconciling of its dual role as a business facilitator and a financial institution. The slow evolutionary process of Islamic banking is exemplified in the prevalence of diluted alternative applications of Shari'a principles instead of the ideal balance between the application of the Profit & Loss Sharing (PLS) mode of financing in measured combination with other fixed return modes.

In response to this, Boubyan Bank offers dynamic and comprehensive knowledge in a financial environment conducive to the development of profit-friendly and risk-mitigating Islamic products and instruments, and advocates for a co-operative effort amongst Islamic banks on regional and global scale.

Boubyan Bank’s Islamic banking and financing models include Mudarabah (profit-sharing and loss-bearing), Wadiah (safekeeping), Musharaka (joint venture), Murabahah (cost-plus), and Ijara (leasing).

.bc47546ea519.svg)