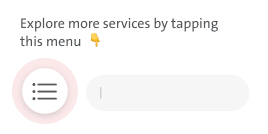

At a Growth Rate of 25%Boubyan Bank Records KD 21.5 Million in Net Profits for the First Half of This Year

The Bank’s Operating Profits For The First Half of The Year Surpassed KD 50 Million at a Growth Rate of 15%

Al-Majed: We Are Optimistic That We Will Have a Good Year Despite Persistent Unfavorable Circumstances

Boubyan Bank has announced KD 50 million in operating profits for the first half of this year, while continuing to allocate provisions amounting to KD 28 million, thereby achieving KD 21.5 million in net profits at a growth rate of 25% compared with the past year, while the earning per share amounting to 6 fils.

Boubyan Bank’s Vice-Chairman & Group Chief Executive Officer, Mr. Adel Al-Majed stated: “Thanks to Almighty Allah, we managed to achieve positive levels of operating and net profits despite the ongoing repercussions of the Covid-19 pandemic, with its clear effect on the banking industry.”

“In spite of the exceptional circumstances we are going through, Boubyan Bank has shown its ability to weather this storm and to continue providing the highest levels of customer service while maintaining flexibility in incorporating our services and products via our various digital channels to make the lives of our customers much easier.”, he added.

Al-Majed, who is also the Chairman of the Bank of London and the Middle East “BLME”, stated that the announcement of Boubyan Bank’s profits coincided with the launch of NOMO Bank, as the world’s first Islamic international Digital Bank through the UK-based Bank of London and the Middle East “BLME”, a member of Boubyan Bank's Group, which will operate subject to the laws of the UK’s financial regulatory authorities.

“This new bank is a demonstration of Boubyan Bank’s strategy in action through international expansion after affirming our domestic position, and follows in the path of our plans to expand our digital banking services.”, he added.

Al-Majed, who is the Chairman of Kuwait Banking Association as well, went on to add: “We hope that all the economic sectors in Kuwait return to work normally in light of the efforts exerted by the various bodies in Kuwait to vaccinate the majority of Kuwaitis and expatriates in order to pave the way for the reopening of all sectors and the gradual return to normal life.”

Al-Majed highlighted the most significant numbers recorded by the bank during the first half of this year where the total of customers’ deposits grew by 15% to reach KD 5.4 billion, while the financing portfolio grew by 12% to reach KD 5.2 billion, and operating income grew by 17% to reach KD 92.6 million.

Speaking of the bank’s market shares, the bank’s share of local financing increased generally to 10.7% approximately, while its share of retail finance grew to about 13.4%.

“Of course, we had to allocate additional precautionary provisions to support the bank’s financial position, and to bolster our ability to face any future repercussions of the ongoing Covid-19 crisis, which is normal as a result of this unprecedented crisis; a first in our modern world.”, Al-Majed elaborated.

Achievements and Successes

Al-Majed went on to highlight prominent achievements during the first half of this year, the most significant of which, was the bank’s regional and international success in undertaking a USD 500 million sukuk issuance at 3.95% annual profit rate.

He added: “The total subscription requests exceeded USD 1.3 billion (the issuance was oversubscribed by 2.6 fold the issued sukuk). This confirms Boubyan Bank’s international and regional status and reputation, gained owing to its achievements over the past years across many levels.”

On the other hand, the crisis caused by the outbreak of the Covid-19 pandemic in Kuwait has revealed the strength of Boubyan Bank and how it continued with its quality customer service without compromising the high levels maintained over the past years. This helped the bank continue topping the pyramid of customer service in Kuwait, which was confirmed by being named the Best Islamic Bank in Customer Service for the eleventh year in a row since 2010 by Service Hero, the international consumer-driven customer satisfaction index.

Furthermore, as a part of the growth plans for our bank’s branches across various areas of Kuwait to serve its customers, the bank inaugurated its new Mubarkiya Branch, designed and dedicated to serving both retail and corporate customers.

Moreover, the bank inaugurated two new branches, the first in the Sabah Al Ahmad area, making Boubyan the first bank with a presence in the area serving customers. This step came to keep up with the rapid urban development and population growth expected for this new city over the upcoming years. Additionally, the bank has opened a new branch at Egeila, thereby expanding the bank’s presence to two branches in the area.

The bank continued supporting its human resources by announcing the acceptance of a new group of employees in GUST’s MBA program, which was been launched over 10 years ago to support the bank’s valued employees, making Boubyan the only bank supporting its employees in their journey to earn an MBA by providing them with moral and financial support.

Since 2012, more than 100 male and female employees have earned their MBA degrees from GUST within the framework of the joint program by Boubyan and GUST, which is managed through the Itqan Academy, the training arm of the bank.

Additionally, the bank participated in several virtual career fairs organized by Kuwait’s universities, where the bank promoted its most significant efforts towards supporting national cadres, whether through attracting them to work at the bank or by providing them with the necessary training and expertise after joining the bank.

The Be Aware Campaign “Diraya”

As a part of its corporate social responsibility, the bank provided its full support to CBK and KBA’s campaign “Be Aware - Diraya” during the first half of this year to spread awareness about a broad range of banking matters amongst citizens and residents.

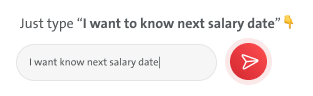

Furthermore, over the past months, the bank launched the biggest campaign in Kuwait to encourage and reward our vaccinated customers, with valuable prizes including trips to other countries abroad inclusive of all costs, in addition to valuable cash prizes to more than 20 winners. Customers may continue to register for the draw through the bank’s app via Msa3ed, our chatbot, by typing “Yes for the vaccine”, and then they will be registered in the campaign immediately.

Similarly, the bank started a staff campaign last January to encourage employees to get vaccinated. This campaign was an instant success with the number of vaccinated employees jumping to more than 70%.

.bc47546ea519.svg)