In His Participation in “Seamless Global Conference” in Dubai

Al-Tuwaijri: The Banking Industry’s Transformations Over the Coming 5 Years Will Be As Big As Transformations Over The Past 5 Decades

Boubyan Bank Has Been Ahead of Others in Being Ready for These Transformations Since 10 Years as the Bank Has Been Investing in Digital Services as per a Clear Strategy for Growth

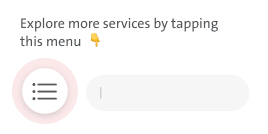

Boubyan Bank’s CEO - Private, Consumer & Digital Banking, Mr. Abdulla Al-Tuwaijri, stated: “The huge technological developments in banking services bring many challenges to banks around the world, especially challenges related to competition and the ability to attract more customers.”

This came as a part of a discussion panel and an interview wherein Mr. Al-Tuwaijri participated during the activities of Seamless Global Conference held in Dubai. The panel discussion focused on payment methods in future banks, while the interview focused on potential transformations in digital banks by 2030, and how this would influence customers.

Al-Tuwaijri explained that banks attempted to strike a balance between traditional in-branch banking service and digital services, while pouring in more investments into digital offerings, and then increasing the segment of customers using such digital banking propositions.

** Toughest Challenges

Speaking about the toughest challenges facing the business while operating in a decentralized payment system, he stated: “There are many challenges, including the different versions of government-driven, corporate-driven, and retail-driven payment systems. This is causing confusion now until they merge into concrete case studies.”

He went on to add: “Among the most prominent challenges are operating standards; any system that is not interoperable will always be at a micro-scale, and the implementation of this new system will take time. We should also take into account that if innovation is too fast for customers, it would be difficult for them to keep up with it. Moreover, we must ensure customers’ privacy, protect them from volatility, reduce financial crime and fraud, and ensure legal compliance.”

** Where are we headed in the future?

Al-Tuwaijri reviewed the outlook for the next five years and what is possible for the bank in the future, as banks may focus on Banking as a Service (BaaS) indirectly, where they leverage their licenses and balance sheets to provide products through 3rd parties.

This can also be achieved through embedded finance where banking services become frictionless and occur outside the existing digital and traditional channels through ecosystems and embedded in everyday routines.

** Importance of Exploring Future Opportunities

Al-Tuwaijri went on to add: “Upon discussing investment in digital banking, the bank took many elements into consideration; the most important element was the youth segment in the Kuwaiti society, which accounts for more than 60% in addition to the rapid and accelerating developments in the world of digital banking across the globe.”

“Boubyan’s name became synonymous with value propositions being offered “for the first time” in Kuwait and the region. The bank was the first in the region to launch digital murabaha, allowing customers to obtain the necessary approvals for murabaha within minutes, whether through their mobile or PC.”, he added.

** Boubyan and Digital Excellence

Furthermore, in his two lectures Al-Tuwaijri highlighted Boubyan Bank’s digital experience, stating that the bank adopted innovation and creativity, while focusing on high quality customer service via digital and traditional channels that is aligned with Kuwaiti and Islamic cultures.

He added: “In Boubyan, innovation is represented in a new business model, a new customer, a new market, a new experience and way of doing things, or - finally - a new technology or tool, while success is measured by striking a balance between quality & quantity, and short-term & long-term.”

He gave an example of the bank’s launch of many first-to-market innovations in Kuwait and the region, citing that some of them evolved into ecosystems, such as link payment (PayMe) that became a verb in Kuwait and a service that people use every day.

** Boubyan Bank During the Pandemic

Al-Tuwaijri stated: “During the Covid-19 Pandemic, Boubyan Bank demonstrated and confirmed its ability to face this situation. The bank was clearly prepared for such situations owing to its investments in digital banking, which were already there long years before the pandemic.”

Al-Tuwaijri also highlighted: “About 50% of our customers’ base were active in digital channels and that figure increased by 20% during the pandemic, and now about 75% of our customers’ base are digitally active.”

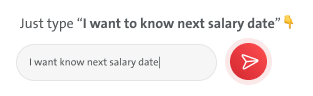

“Our Digital Assistant, Msa3ed, was more than just a chatbot during the pandemic; it was helping with many CSR initiatives, including spreading awareness and guidance on vaccinations, and how to book appointments with government entities, etc.”, he added.

** Nomo... Bank of the Future

During a special interview, Al-Tuwaijri dwelt on Boubyan Bank’s steps towards digital expansion through last July’s announcement of the full launch of Nomo Bank in Kuwait and U.K. as the first Islamic digital bank from London which can offer its services to Boubyan Bank’s customers and non-customers.

Al-Tuwaijri went on to add: “The new Nomo’s digital-first banking experience lets users apply for a UK-based bank account in minutes using their smart phones, thereby giving them the chance to enjoy unique banking experience in Kuwait and worldwide.”

“This cuts out lengthy application processes that can take a prolonged time. Also, through a clear and intuitive smartphone App, Nomo allows its customers to spend, send and invest their wealth on the go, with 24/7 access wherever their lifestyle takes them.”, he added.

He elaborated: “Nomo’s banking proposition is unique in that it gives non-UK residents from Kuwait, and soon from GCC, the great opportunity of opening a UK-based account and enjoying the many prestigious benefits of the UK banking system. Also, the local banking solutions of the new bank help customers avoid high international fees and open up investment opportunities that would not be usually available to non-UK residents.”

.bc47546ea519.svg)